by Erica Salmon Byrne

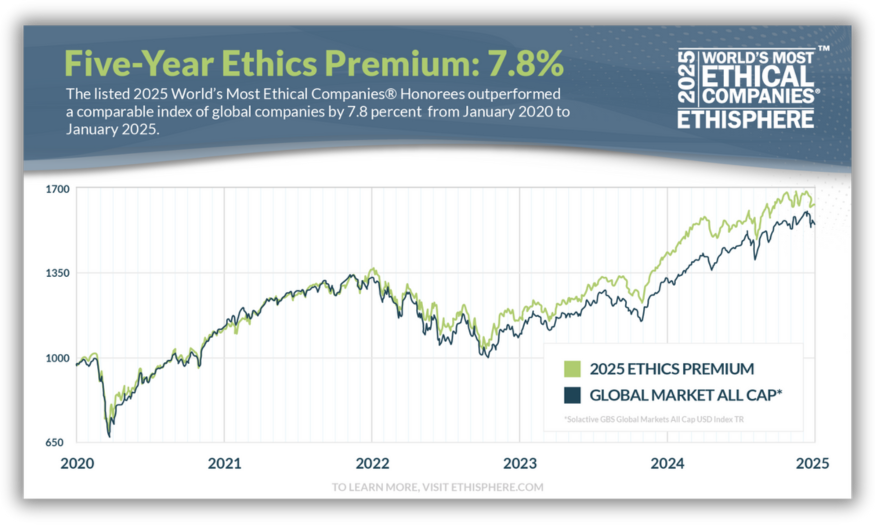

Ethisphere’s Five-Year Ethics Premium for 2025 is 7.8%, which represents the margin by which publicly traded companies recognized in this year’s World’s Most Ethical Companies outperformed a comparable index of global companies over a five-year period from January 2020 to January 2025. 7.8% is quite a respectable number, given wider signs of economic headwinds and uncertainty. But more than that, the Ethics Premium has something important to teach us about the long-term value creation of business integrity.

Ethisphere started calculating the Ethics Premium about halfway through the tenure of the World’s Most Ethical Companies recognition. It was a response to the economic turmoil of 2008-2010, when many ethics and compliance teams told us they were hearing from leadership things like “that’s nice but not in times like this” or “we’ll get back to doing the right thing after the crisis is over.” These leaders somehow believed there was an inherent tension between businesses doing the right thing and making money, and that choosing between the two was a zero-sum decision. Ethisphere strongly suspected that perspective was fundamentally flawed and tested it against an important piece of publicly available information common to many World’s Most Ethical Companies honorees—share price.

Ethisphere created an index of the publicly traded companies on the list and weighted them so no one company on the list was worth more than 8% of the index. Then, we began to look back over a five-year period to see how the performance of publicly held honorees of the World’s Most Ethical Companies compared (because we’re firm advocates of long-term thinking). We have a partner that calculates for us the performance of publicly traded honoree companies compared to a comparable (e.g., similar industries and countries of operation) index. And they do it during the quiet period before any given year’s list of honorees is made public, so as to not affect stock price that way, either.

Every single year that we have done this calculation, there has been an outperformance.

The first year we did it, the outperformance was 4%—that is, the public honorees of that year’s World’s Most Ethical Companies collectively had a 4% better stock performance than a comparable index of companies over the lookback period. Since then, we have seen years with double-digit outperformance. We’ve had outperformance as high as 25% one year. But there has always been a statistically significant percentage of outperformance.

Why is that? We’re not saying we have causation – but what we do have is a decade’s worth of correlation. And I believe that the correlation is as strong as it is because the kinds of practices that put a company on the list in any given year are those that mitigate risk, safeguard intangible assets, and unlock the potential of your biggest asset – your people.

The Ethics Premium illustrates how ethical businesses do better over the long-term, are more sustainable, and more likely to be around in 10 years. But more importantly, it proves conclusively that you don’t have to choose between ethical behavior and strong, long-term financial performance. We were right all along. Strong ethics is good business, and thanks to the Ethics Premium, we have the numbers to back it up.