by Bill Coffin

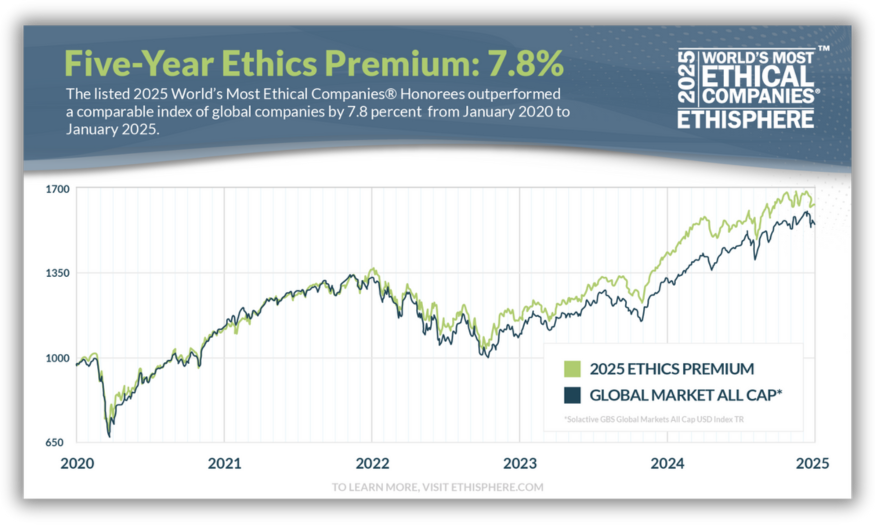

Anyone who has watched an episode of the Ethicast will be familiar with my signoff: “Strong ethics is good business.” I say that because I believe it deeply. Ethics is not a feelgood exercise or a drift into ideology. It is a strategic differentiator that builds better businesses by making them more innovative, more resilient, and more attractive to talent, markets, and capital. And best of all, this isn’t just a passionately held opinion. Through the Five-Year Ethics Premium, we have the data to back it up.

This year, the Ethics premium is 7.8%. That’s the amount by which the publicly held honorees of this year’s World’s Most Ethical Companies have outperformed a comparable index of their peers over the last five years. That’s not a small number. But what would a direct investment in long-time World’s Most Ethical Companies honorees look like from a long-term return perspective?

Let’s Find Out

There are 136 honorees in the 2025 World’s Most Ethical Companies. (You can see the full honoree list here.) Of those, there are 49 honorees that are both publicly held and have been recognized 10 or more times. We will look at this cohort, as a benchmark of the long-term value creation of best-in-class business integrity.

Next, we will determine the share price of each company on Jan. 2 of the year they first earned World’s Most Ethical Companies honors. (A few of them went public later in the year after their first recognition, so their starting stock price will be set to that date.) Then, we will determine the share prices of these companies on Jan. 3, 2025, the first trading close of this year.

For this exercise, we will invest $100,000 – an amount large enough to buy a decent chunk of stock without verging into numbers so big they lose their meaning—into each honoree company on Jan. 2 of their first year of World’s Most Ethical Companies recognition. We’ll divide that by the starting share price. To keep things simple, we will use dollar-based investing, so this fictional investment amount can buy fractions of a share. Now we know how many imaginary shares we would own of the honoree company. Then we multiply the number of shares by the Jan. 3, 2025 share price to see what the investment is worth today. We repeat this for each of the 49 companies

So, How Did We Do?

The entire seed funding for this project is $4.9 million USD ($100K x 49 companies) paid into the fund by variable amounts from 2007 through 2016.

By Jan 3, 2025, the total value of these 49 stock holdings amounted to $17,949,045 (rounded up). The total seed fund grew over time by 366%, for a nearly 3.6x total return on investment. Total profit on this fund is $13,049,045 over the life of the fund. This only reflects stock price and does not include shareholder dividends.

So, there we have it. It’s a simple and easily replicated model that relies entirely on publicly available information. Variants of this model run against different cohorts of publicly held World’s Most Ethical Companies honorees will produce similarly compelling results. Any investment in ethics pays off, but as our experiment here shows, the more you invest in ethics, the more it pays off, because the value of ethics scales upward. Amid times of turmoil and uncertainty, ethics remains one of the safest investments around.

Invested Companies

- Accenture – ACN (NYSE)

- Aflac, Inc. – AFL (NYSE)

- Allstate Insurance Company – ALL (NYSE)

- Anywhere Real Estate Inc. – HOUS (NYSE)

- Aptiv PLC – APTV (NYSE)

- Best Buy Co., Inc. – BBY (NYSE)

- Capgemini – CAP.PA (Euronext Paris)

- CBRE Inc. – CBRE (NYSE)

- Colgate-Palmolive Company – CL (NYSE)

- Deere & Company – DE (NYSE)

- Dell Inc. – DELL (NYSE)

- Eaton – ETN (NYSE)

- Ecolab – ECL (NYSE)

- Energias de Portugal, SA (EDP) – EDP.LS (Euronext Lisbon)

- HCA Healthcare, Inc. – HCA (NYSE)

- Henry Schein, Inc. – HSIC (NASDAQ)

- Iberdrola, S.A. – IBE.MC (Bolsa de Madrid)

- Ingredion Incorporated – INGR (NYSE)

- Intel Corporation – INTC (NASDAQ)

- International Paper Company – IP (NYSE)

- JLL (Jones Lang LaSalle Incorporated) – JLL (NYSE)

- Johnson Controls, Inc. – JCI (NYSE)

- Kao Corporation – 4452.T (Tokyo Stock Exchange)

- Kellanova (Formerly Kellogg’s North America) – K (NYSE)

- Kimberly-Clark – KMB (NYSE)

- L’ORÉAL – OR.PA (Euronext Paris)

- ManpowerGroup – MAN (NYSE)

- Mastercard – MA (NYSE)

- Oshkosh Corporation – OSK (NYSE)

- Parsons Corporation – PSN (NYSE)

- Paychex – PAYX (NASDAQ)

- PepsiCo Inc. – PEP (NASDAQ)

- Premier, Inc. – PINC (NASDAQ)

- Principal Financial Group – PFG (NASDAQ)

- Prudential Financial, Inc. – PRU (NYSE)

- Rockwell Automation Inc. – ROK (NYSE)

- Royal Caribbean Group – RCL (NYSE)

- Salesforce – CRM (NYSE)

- Schneider Electric – SU.PA (Euronext Paris)

- TE Connectivity – TEL (NYSE)

- Teradata Corporation – TDC (NYSE)

- The AES Corporation – AES (NYSE)

- The Hartford – HIG (NYSE)

- The Timken Company – TKR (NYSE)

- U.S. Bancorp – USB (NYSE)

- Visa Inc. – V (NYSE)

- Voya Financial – VOYA (NYSE)

- Waste Management Inc. – WM (NYSE)

- Weyerhaeuser – WY (NYSE)

Note: A handful of these honoree stocks trade in Euros, and one trades in Japanese yen. For each, we convert USD to those currencies for the purchase year to get a sense of how far $100K would buy at that time. We then run the same share purchase formula to see how much the investment was worth in 2025 and then converted that amount back to USD so the final results are all a single currency.